Empowerment Series: How a U Choose Loan Put a Roof Over a Wisconsin Family’s Head

November 7, 2018

U Choose Loans: Shelter from Financial Storms

We’ve all been there, haven’t we? When money’s tight, an unexpected expense pops up. It’s no wonder this is so common when considering that 23% of Americans – about 55 million people – have no emergency savings.

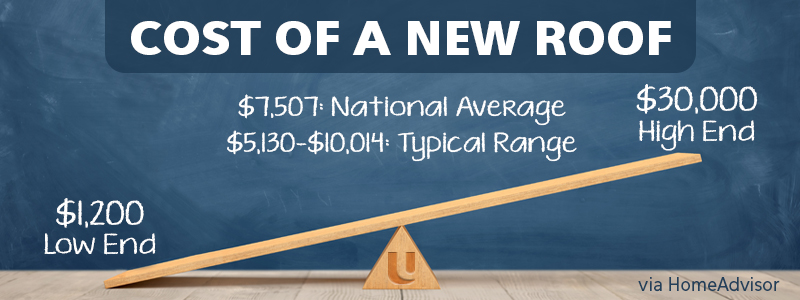

This was exactly the case for a Wisconsin mom. As summer turned to fall and temperatures started to drop, she noticed bubbles in her ceiling. Upon a professional’s inspection, it was clear that her roof was caving in. The damage was so severe that a new roof was needed, and that’s no small expense.

With cold weather approaching, warmth and shelter compromised, and not enough money to cover a new roof, our mom was stressed and concerned for her family’s safety. So, she took advice from a friend and visited our Wrightstown branch for help. Steve Hoelzel, Member Advisor-turned-Branch Manager, was there to greet her.

Putting a Roof Over a Wisconsin Family’s Head

Steve and our Wisconsin mom sat down to talk through her roofing issues and what her options were, especially considering that most roofers do not offer financing. They reviewed her financial and job history to find the best possible solution. After collaborating with another branch manager, Steve suggested an unsecured—or a U Choose—loan.

Steve Hoelzel, Unison Credit Union Branch Manager

With the right solution in hand, it was time to ease the member’s mind. He remembers, “I told her, ‘It’s going to take a little bit of time, but I’ll get everything done for you today. If everything looks good, we can get you back to sign paperwork.’”

When our Wisconsin mom left the Wrightstown branch, everything was ready to go. The last thing she needed to provide was a contractor’s name to which Steve could make out the check.

As Steve recalls, “The entire process took about an hour and fifteen minutes, including opening a new account.” If you’re surprised that a small-town credit union could take this on in so little time, you’re not the only one. Steve says, “Wrightstown is a small, tight-knit community, and she was in awe with how fast we were able to turn it around.”

So, in addition to getting the funds she needed for a necessary home repair within 24 hours from a financial institution close to home, this Wisconsin mom kept her appointment time short.

New roof? Mission accomplished.

Our Wisconsin mom is “ecstatic” about her repaired roof. In fact, she was so grateful for her positive experience with Unison that she’s in the process of moving her accounts over from another financial institution and stops in regularly to say hello.

Why should you choose a U Choose loan?

Hence the name, our U Choose loan is an unsecured loan up to $30,000 with which you can do anything. And, when you get an unsecured loan with a credit union, you get a much lower APR than you’d find with a bank.

Here are five reasons why U Choose loans are great options when you need money ASAP:

- Easy online application (no appointment necessary!)

- No collateral needed

- Fast approval process

- Rates as low as 7.99% APR*

- Guidance from Member Advisors

Ways to Use a U Choose Loan

When unanticipated costs come up, choose our U Choose loans. Here are some of the emergency expenses you could cover:

- Flood/storm damage repair

- New water heater

- New furnace

- Medical/dental bills

- Sudden moves

- Unexpected travel

- Car expenses

- Job loss

- Plumbing repair

Weathering a financial storm? We’ve got you covered.

For everyone that comes through our doors, the mission is the same: to provide real, actionable solutions and tailored, effective financial advice.

Steve says it best:

“It’s a good feeling knowing that members can come to us in their time of need and we can help them. We make sure to give members the best advice and point them in the right direction. We focus on dos, don’ts, and the “why” of each financial step they take.”

Steve has another piece of actionable advice: set up an emergency fund in addition to your checking and savings. And, instead of needing to remember to put money in that account every month, we suggest setting up a recurring transfer from your checking to your emergency fund. That way, when unforeseen expenses arise, you’re ready to pay for them immediately.

When you’re in need of quick cash, a business loan, a home equity loan, or a checking account, we’re here. Stop by one of our Wisconsin hometown branch locations – our Member Advisors and Branch Managers are ready and waiting to help you weather any financial storm.

Read up on other times we helped our members do big things:

- Helping a Dad Pay for College

- Financial Help for a Growing Fox Valley Family

- How Refinancing Helped a Fox Valley Truck Driver Make More Family Time