Empowerment Series: How Refinancing Helped a Fox Valley Truck Driver Make More Family Time

January 17, 2018

Member Advisors at Unison Credit Union understand that every personal finance situation is unique. Sometimes people visit our Northeast Wisconsin branches with their finances in perfect order, and others come to us with monetary emergencies. No matter the case, we’re always here to listen and help.

Ryan Huebner, branch manager at our Grand Chute credit union location, tells us about a Unison member who was very worried that his tight budget would eventually cause financial difficulties. So, this man wisely brought his concerns to us for guidance and solutions.

Huebner describes the man as a divorced, single dad who is on the road a lot because of his job as a truck driver. While the man’s financial situation wasn’t out of control, his debt-to-income ratio was high, and child support payments combined with a mortgage, credit card debt, and personal loans left him without much to put into savings or use in case of an unexpected financial need.

“He was definitely keeping up with his support payments and paying all of his monthly bills,” Huebner says. “However, his budget was tight because of high payments, and he felt like he was spinning his wheels, unable to make much progress paying down his debt.”

Taking Financial Responsibility for Family

In addition to having a daughter and son to help support, this member was also caring for his mother who’d moved into his Fox Valley home.

To make sure he could support his children and keep up with his bills, the man was spending even more time at work and on the road. All that traveling meant less time with his kids and leaving his aging mother alone at home for extended periods of time.

“He was completely stressed out about the possibility of falling behind financially,” Huebner recalls. “He was very focused on making sure he had the finances he needed to support his kids. When you talk with him, you can tell how important his family is.”

Money matters were not his area of expertise but, thankfully, this truck driver pulled up to the right place.

“When we first sat down, he explained that he didn’t really know much about finances, and he was very grateful to have us take a look at everything,” says Huebner.

When Huebner went over the man’s statements and financial obligations, he saw that he was making a high mortgage payment and that much better interest rates were available. Huebner also saw the man’s home as an important asset that could provide a solution.

“I spoke with him about how the current mortgage industry was booming in the Fox Valley and appraisals were coming in high,” he says. “I explained that he should give appraisal and refinancing a shot so we could see what Unison could do.”

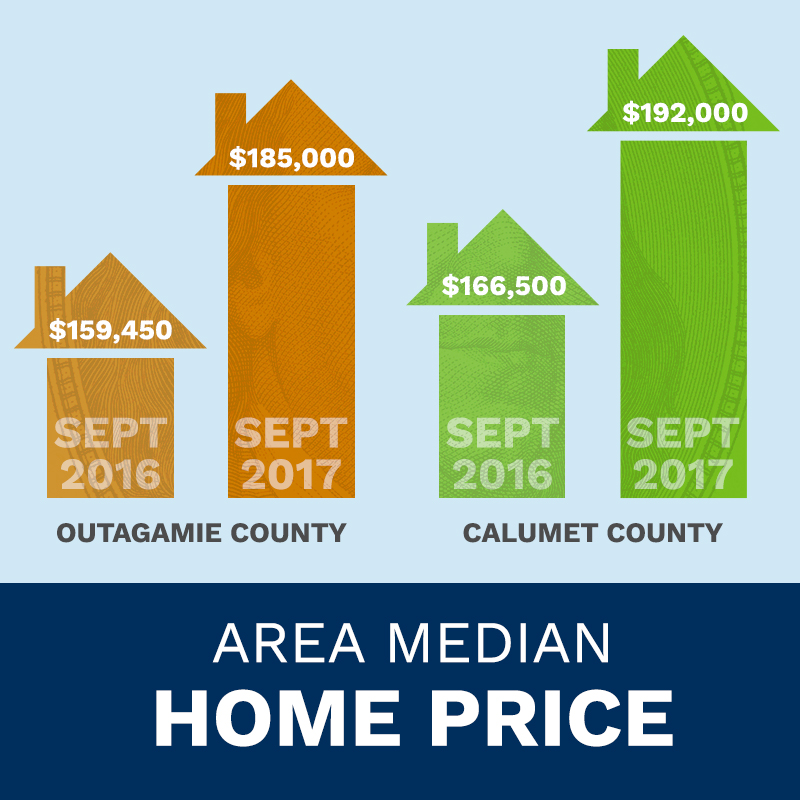

Huebner’s knowledge of the local housing market was spot on. According to the Wisconsin Realtors Association (WRA), median home prices in counties such as Outagamie and Calumet rose between 14 and 17 percent when comparing September of 2017 to September 2016.

Huebner’s plan was to lower the man’s mortgage payment and consolidate his debt at the same time.

Huebner’s plan was to lower the man’s mortgage payment and consolidate his debt at the same time.

“We gave him a scenario where we’d combine all of his debt, including the mortgage, and amortize a new loan over thirty years,” Huebner explains. “By giving him a better interest rate, we were confident Unison could cut his payments in half and provide him with hundreds of dollars of additional available income each month.”

The Surprising Appraisal

After getting permission to proceed from the member, Huebner got right to work. He had the member fill out an application for refinancing the mortgage and ordered an appraisal on the man’s home. Huebner knew that Fox Valley homes had been rising in value, and the higher the appraisal, the more options would be available to this member.

When the moment of truth came, it was good news.

“To his surprise, the appraisal came in a lot higher than he thought,” Huebner says. “We were able to consolidate all of his debt while leaving a little extra money for him to put his finances in order.”

Before he visited Unison for help, Huebner says the man was paying a monthly mortgage of around $1,000, in addition to covering other loans and credit card debt. Unison was able to help him wrap all of the debt into one monthly payment of $611.

Suddenly, this man went from wondering if he’d have anything left after paying his bills every month to having extra income in his checking account. That made a significant difference.

“A few hundred dollars a month in available income can be life-changing and dramatically alter your quality of living,” Huebner says. “He’s the type of guy who was constantly working. Now that we helped him free up some income, he can choose to spend more time with his family.”

This man has a son serving at a U.S. military base, and a daughter who splits her time between parents. He wanted to make sure he could be with his children whenever he had the chance. Now, not only does he have peace of mind on money matters, he’s also gained something even more valuable, time to make memories with family.

How Can Unison Credit Union Empower You?

This member had the courage to admit he didn’t have all the answers. That can be difficult to do, but it’s a lot easier when you work with people who understand your situation. If you feel like you could benefit from our guidance, Unison’s Member Advisors are here to show you the way towards financial freedom.

“Sometimes people are completely surprised by what the result can be,” says Huebner. “They feel buried and hopeless because they assume there’s no solution, but it’s so much easier than you think, and fixing financial problems can be such a relief.”

Huebner wants people in Northeast Wisconsin to realize that it all starts with taking a few minutes to talk to a Unison Member Advisor.

“We’re here to guide you towards the right answers, not to judge your financial situation,” he says.

Stop by a Unison Credit Union location today and find out how we’re “Empowering You” to live the life you deserve. Visit one of our conveniently located branches in North Kaukauna, South Kaukauna, Little Chute, Grand Chute, Wrightstown, or De Pere. You can also check out current rates for fixed rate mortgages and adjustable rate mortgages from Unison* and begin the application process online. Each person’s financial situation is unique. Individual results may vary. Stop in or call us to see how we can assist in Empowering You!”

*Membership eligibility applies.

FEDERALLY INSURED BY NCUA.