Savings Accounts, Money Markets, and Certificates—What You Should Know

February 22, 2019

With so many bills putting pressure on our wallets, it might be hard to think about starting to seriously save or invest your money. Rent, cost of living, student loan payments; because all of these eat up your hard-earned cash fast, you may be waiting to save. Or, maybe you have an established savings that you’re looking to grow but aren’t sure where to start.

The good news? We offer a number of ways to help you save—no matter what level you’re at.

Ways to Save Your Money: Breaking it Down

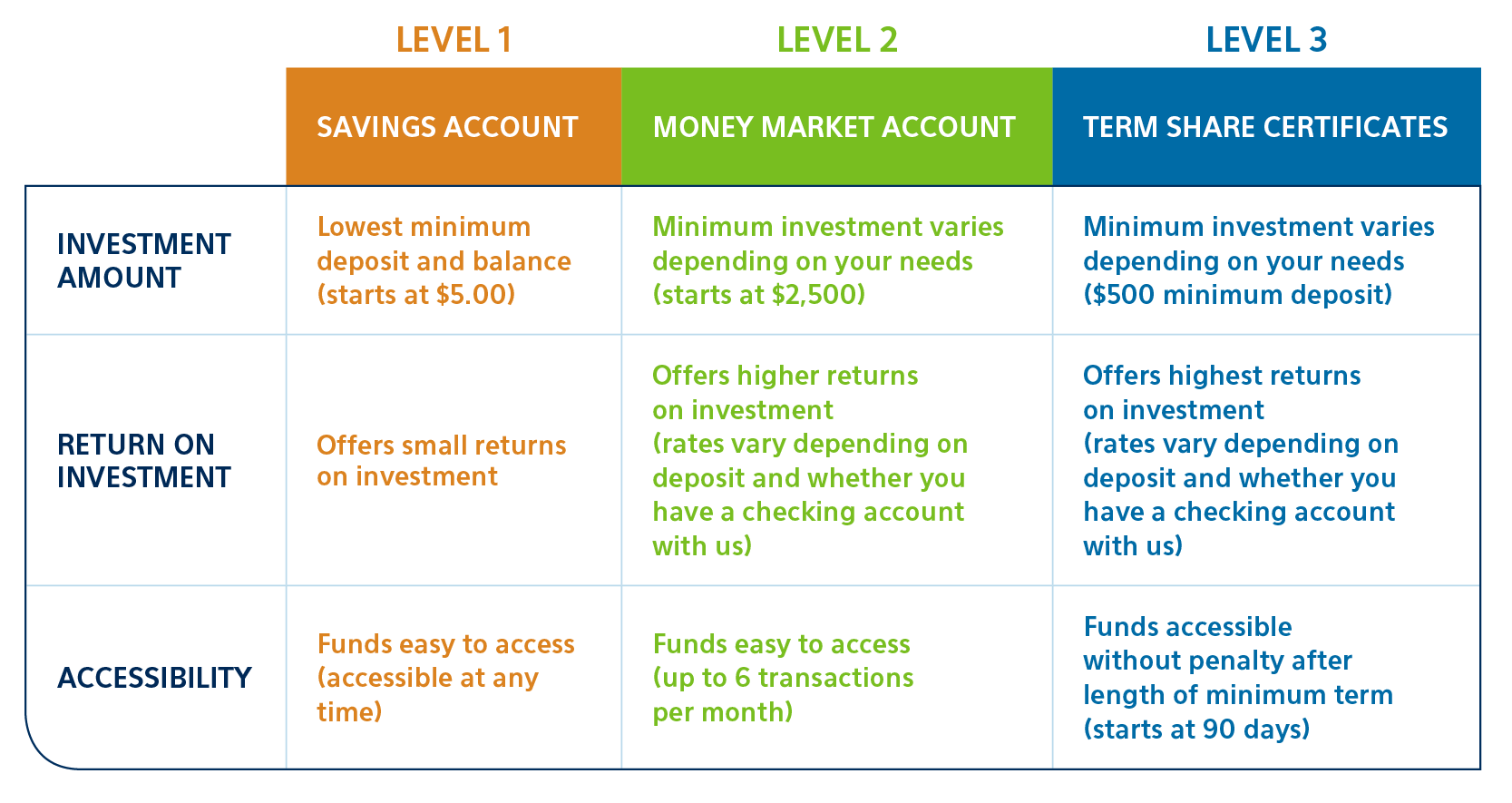

If you’re thinking about starting or growing your savings, there are various options to choose from depending on your personal goals and financial situation. Three popular accounts that our Member Advisors typically share are savings accounts, money market accounts, and term share certificates. These accounts vary in terms of interest rates, output, and accessibility to funds.

Savings Accounts: Basics

Savings accounts are separate from checking accounts and are meant for, well … saving. These accounts are used to put money aside to work toward a larger financial goal. Generally, money in savings accounts earns interest, or dividends, which means that the credit union will pay you interest on the money you deposit and leave in the account. Dividend and annual percentage yield (APY) rates for savings accounts are variable, which means they can go up or down any time.

So, What’s a Money Market Account?

A money market account is similar to a savings account, but the two main differences between them are return on investment and the level of access to funds. In money market accounts, you can still deposit and take money out of the account at any time, but you’ll earn higher interest rates on the money you leave in (interest and annual percentage yield rates, like savings accounts, are still variable with money market accounts). Money market accounts can also earn higher interest rates if you have a checking account with us.

And What about These “Certificates”?

A term share certificate is a type of savings, or investment, in which you put aside a sum of money for a pre-determined amount of time. Unlike savings and money market accounts, you receive a guaranteed rate for the term of your investment. However, you are unable to withdraw your funds until the end of the term without paying an early withdrawal penalty.

Want to Save $$$? Pick Your Level

Choosing the Right One for You

Feeling indecisive? You can think of these accounts in terms of what we like to call “The Goldilocks Scenario.” A savings account is the baby bear of them all—great for getting your feet wet with saving money or for setting aside funds for specific purchases or circumstances. Maybe you want to start small and put a few bucks away every month until you get that higher salary (our share savings account is a great option for that, requiring a minimum of just $5.00). Or, you want to go a little bigger and start putting chunks away for travel, an emergency, or even Christmas gifts (a sub-share savings account). These are all perfect scenarios for Unison’s savings accounts.

Feeling indecisive? You can think of these accounts in terms of what we like to call “The Goldilocks Scenario.” A savings account is the baby bear of them all—great for getting your feet wet with saving money or for setting aside funds for specific purchases or circumstances. Maybe you want to start small and put a few bucks away every month until you get that higher salary (our share savings account is a great option for that, requiring a minimum of just $5.00). Or, you want to go a little bigger and start putting chunks away for travel, an emergency, or even Christmas gifts (a sub-share savings account). These are all perfect scenarios for Unison’s savings accounts.

Money market accounts, on the other hand, can be considered mama bears—they hold the middle ground between savings accounts and term share certificates. They work similarly to savings accounts—you can still deposit and withdraw your funds any time (up to six times a month)—but require a higher minimum deposit. They offer higher return on investment (ROI) than savings accounts, but you’ll generally get back a lower amount than term share certificates.

Money market accounts, on the other hand, can be considered mama bears—they hold the middle ground between savings accounts and term share certificates. They work similarly to savings accounts—you can still deposit and withdraw your funds any time (up to six times a month)—but require a higher minimum deposit. They offer higher return on investment (ROI) than savings accounts, but you’ll generally get back a lower amount than term share certificates.

Which brings us, then, to term share certificates—the papa bears of the three accounts. These accounts offer the highest rates on dividends (but like money market accounts, require higher minimum deposits than savings accounts). Term share certificates are good for long-term saving, such as for college or emergency funds, but your money must remain in the account for the duration of the term you’ve chosen. The papa bears are still low-risk in terms of investment accounts, and your funds are still relatively easy to access, but you won’t be able to reap the full benefits if you withdraw your funds early.

Which brings us, then, to term share certificates—the papa bears of the three accounts. These accounts offer the highest rates on dividends (but like money market accounts, require higher minimum deposits than savings accounts). Term share certificates are good for long-term saving, such as for college or emergency funds, but your money must remain in the account for the duration of the term you’ve chosen. The papa bears are still low-risk in terms of investment accounts, and your funds are still relatively easy to access, but you won’t be able to reap the full benefits if you withdraw your funds early.

The Best Part

These are only a few of the options that we offer—Unison has health savings accounts and property tax savings accounts available, and we even have options for children and young adults who want to get started saving (Moola Moola or Serious Savings accounts). It’s easy to open and access any of these accounts, and we offer e-statements and online or mobile banking. For some accounts, you can also make deposits through your mobile phone. And, you can rest assured your money is secure and safe. We’re federally insured by the NCUA (National Credit Union Administration) and committed to keeping your accounts secure by using top-of-the-line internet security technologies.

Ready to get started or need more information on ways to save? Consult the experts! Stop by one of our branch locations and meet with a Member Advisor to help you find the right fit.