Empowerment Series: Financial Help for a Growing Family in the Fox Valley

November 14, 2017

How Unison Member Advisors Can Guide Your Way Out of Debt

Each stage of life comes with unique challenges and treasured moments, but sometimes financial burdens prevent you from moving forward and creating the life you want to live.

That was the case for a Fox Valley couple who recently visited Unison Credit Union’s South Kaukauna location and met with Member Advisor, Jeanna Fleischman.

Jeanna says the husband and wife were hoping to refinance their mortgage and wrap credit card debt into one loan. Unfortunately, they didn’t have enough equity in their home to make that possible. Still, Jeanna knew there were other debt consolidation options that would let this small family get a handle on their financial situation.

When Jeanna met the couple, she saw how helping them find a path towards financial stability would impact much more than their checking and savings accounts.

“They had their young daughter with them and said to her, ‘Mommy and Daddy are working on consolidating their debt so you can have a little brother or sister, what do you think about that?’ It was just really cute!”

Using a U Choose Loan to Get Credit Card Debt Under Control

The couple brought in their credit card statements so Jeanna could get an accurate picture of the amount of debt they were dealing with. The numbers were certainly substantial. However, this is the kind of thing Unison Member Advisors assist people in Northeast Wisconsin with every day.

“They had just over $37,000 in credit card debt and they were paying $2,400 a month to make the minimum payments,” she says. “When we looked at their credit card statements together we saw they wouldn’t be able to pay off some of those cards for almost 20 years.”

According to research from personal finance comparison site, Value Penguin, the average American household carries $5,700 in revolving credit card debt, and Wisconsin falls just below that average. In Northeast Wisconsin, we’re doing a bit better. Average credit card debt for households in the Green Bay/Appleton area is $4,363.

It’s easy to see why this family’s credit card felt overwhelming to them. However, it’s not uncommon either. Unison Member Advisors understand how this situation could happen to anyone.

“There’s no judgement here,” assures Jeanna.

Jeanna identified our U Choose loan as an ideal way to consolidate the family’s credit card debt and make payments much more manageable.

“We were able to set up an unsecured U Choose loan for them at 66 months and lowered the interest rate to 8.24%,” Jeanna explains. “That’s compared to some of their credit cards, which had interest rates as high as 25%. With the U Choose loan, their monthly payment is about $800, a third of what they were paying the credit card companies.”

Let’s recap what we accomplished by consolidating credit card debt with a U Choose loan. Jeanna showed the couple a way to significantly reduce the time it would take to pay off their debt while also reducing the monthly payment, slashing the interest rate, and giving the family an additional $1,600 each month in their budget.

Take a look at this illustration comparing the family’s situation before and after we empowered this family with a plan for credit card debt consolidation.

That’s a major difference in available income for a young family, and this couple was extremely grateful for Jeanna’s financial advice and guidance.

“They were very thankful we were able to help them and excited to get on a path where they’d have some extra money on hand,” she says. “Now, they’ll be able to start saving and make it possible to see their little family grow.”

The Cost of a Growing Family

Even though bundles of joy sometimes come as surprises and perfect planning is tough, it helps to understand how much having a baby can cost.

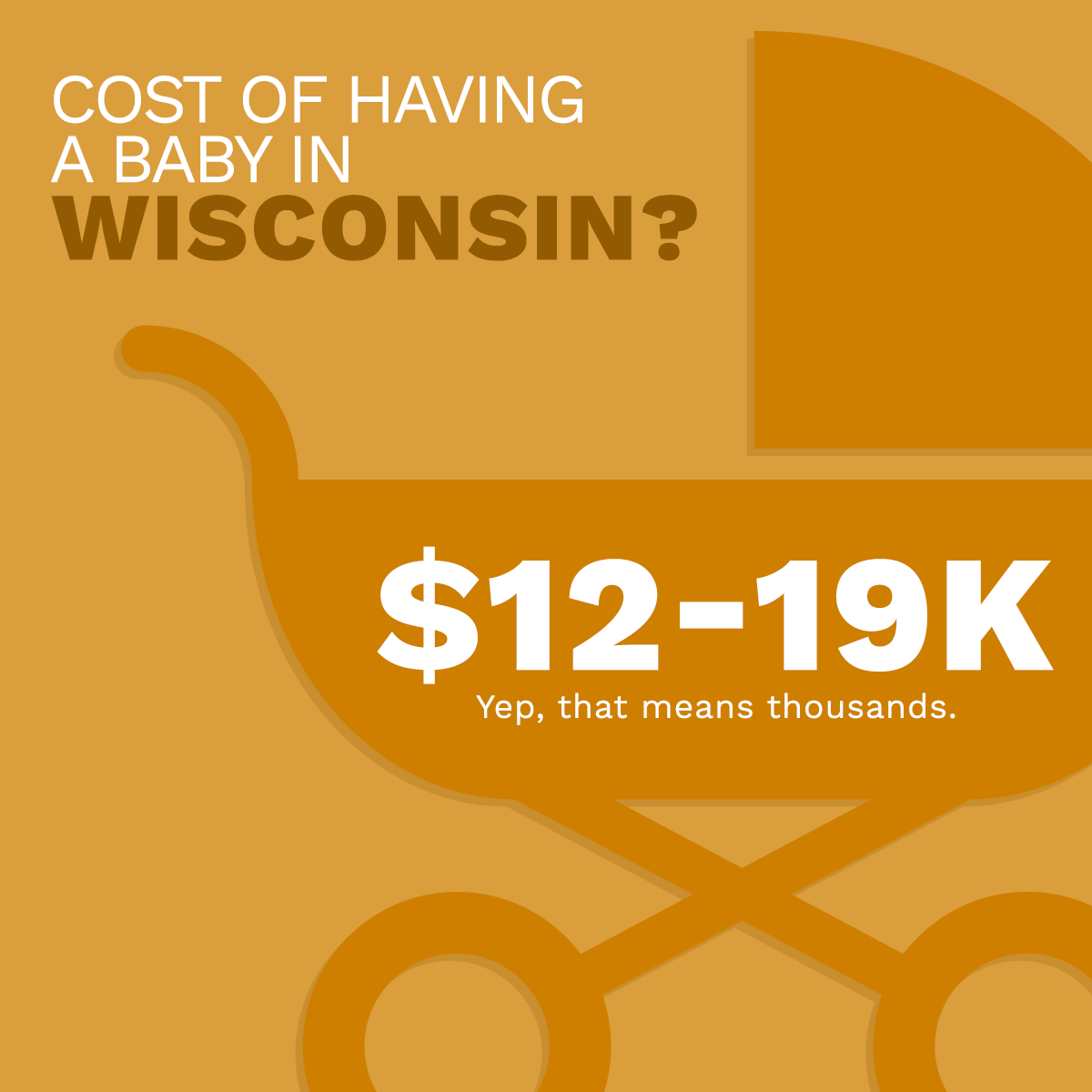

NerdWallet.com says data from the U.S. Department of Health and Human Services indicates the national median for childbirth and hospital stays is more than $13,000 for mothers and more than $3,600 for newborns. When it comes to Wisconsin, the Journal Sentinel reports that a study from the Health Care Cost Institute found it can cost anywhere between $12,000 and $19,000 for a non-caesarean delivery in our state.

Federal law requires that health insurance carriers provide coverage for pregnancy and maternity care. Your out of pocket costs depend on your plan’s copays, coinsurance, and deductibles. So, if you’re preparing to have a baby, it’s smart to look at your health insurance coverage to determine what your financial responsibility could be.

Of course, the medical costs of bringing a baby into the world are just the beginning. Adding a new child to your family will likely require financial adjustments for years to come. From the diapers and formula of the early days to the wants and needs of a teenager, caring for kids is costly.

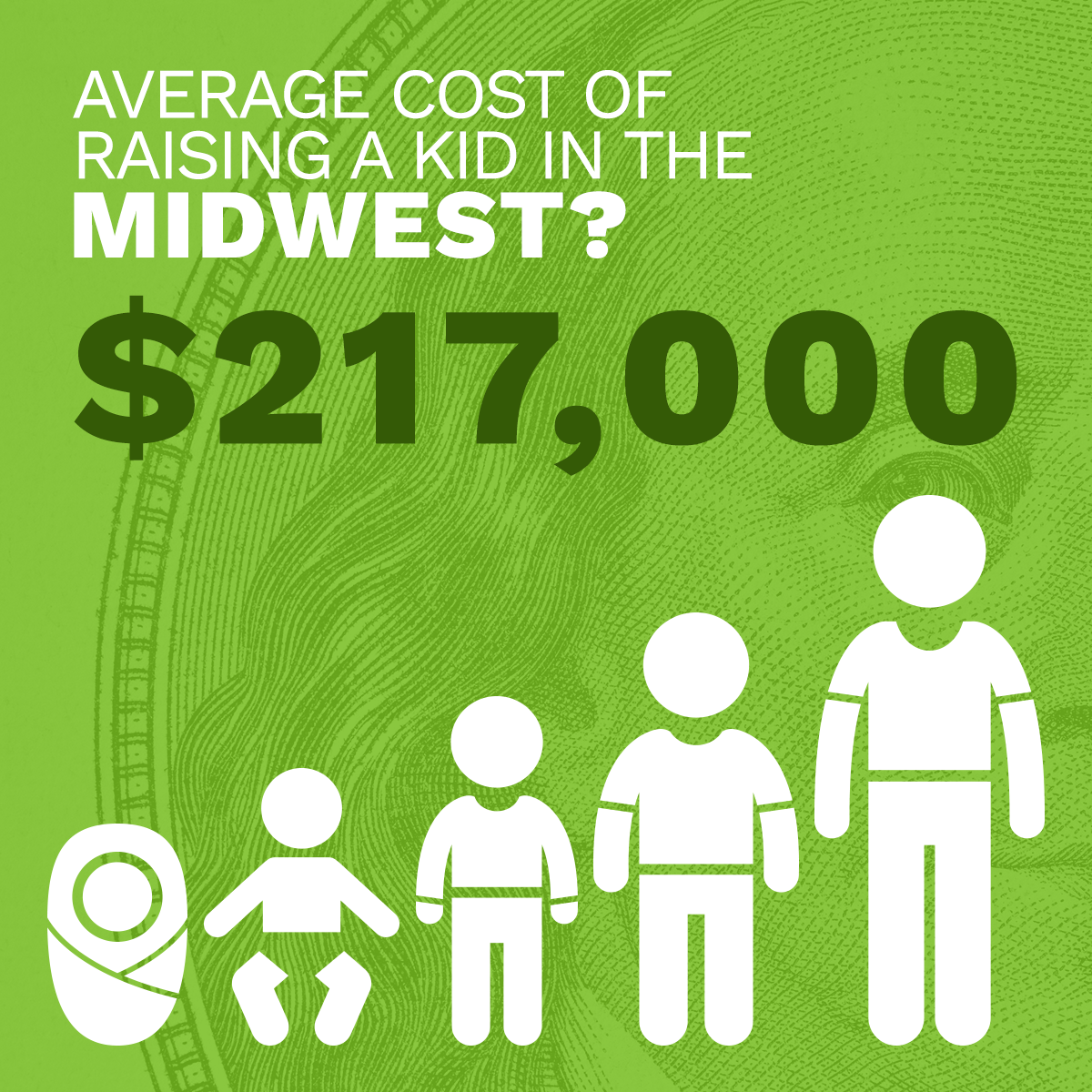

The U.S. Department of Agriculture (USDA) estimates it takes an average of $233,000 to raise a child from birth to age 17 in America. While it’s slightly less costly in Wisconsin, it’s still a big number. Raising a child in Midwestern states like Wisconsin costs an average of $217,000. That covers housing, food, transportation, clothing, health care, and education up until but not including college.

If you want to estimate the price tag of having multiple kids, check out the USDA’s Cost of Raising a Child Calculator. Regardless, any parent will tell you that the joy of raising children far outweighs any impact to your wallet, but with all the challenges of parenting, the money part will be easier with a good plan.

Get One-on-One Advice from Unison Member Advisors

Millennials, such as the young couple in this story, tend to have a reputation for credit card debt problems as well as difficulty establishing savings. A survey found 48% of millennials carry credit card balances and 45% don’t know the interest rate they’re paying.

However, out of control credit card debt can happen at any age. For example, read our Empowerment Series story on the father who helped his kids pay for college with credits cards. Lack of savings isn’t an exclusive problem for younger generations either. A recent GoBankingRates.com survey found more than half of all Americans have less than $1,000 in savings.

Jeanna Fleischman says she and other Member Advisors work with many different people to overcome money problems and establish financial responsibility.

“I often suggest that people set up auto transfers that occur whenever a Unison member gets a paycheck,” she says. “Sub-share savings can be very helpful. Every time you get paid, a set dollar amount goes into a savings account. It’s as if you don’t even see that money since it’s not in your main checking account. The funds are out of sight and out of mind so you’re less likely to spend them.”

Whether it’s a U Choose Loan, savings account, or a strategy for your personal investments, Unison Credit Union’s helpful Member Advisors are ready to help you to tackle problems and put you on a better financial path. We’re here to empower you to start living life on your own terms.

Stop in and visit one of our six branches soon. We’re conveniently located in North Kaukauna, South Kaukauna, Little Chute, Grand Chute, Wrightstown, and De Pere.