2019 Financial Resolutions: Tips for Saving Money

January 9, 2019

What have you resolved to do in the coming year? Many people want to drop a few pounds, get their clutter in order, or learn a new language. Others want to grow their money like Popeye’s biceps on spinach – and, if you’re in that camp, this blog was written to help you get started.

5 Easy Ways to Save More Money in 2019

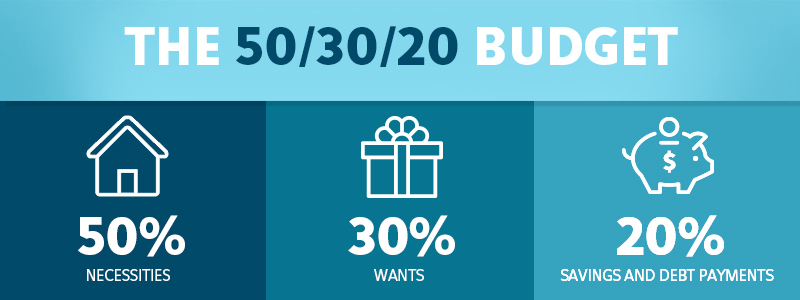

1. Try the 50/30/20 Budget

NerdWallet recommends the 50/30/20 budget for managing debt while leaving room for occasional indulgences and decent savings.

Let’s say you take home $2,400 a month. When you adhere to this budget breakdown, here’s how your monthly expenditures should look:

- Necessities: $1,200

- Wants: $720

- Savings and debt payments: $480

- Total yearly savings potential: $5,760

If you stuck to this budget and socked away even 70% of your savings and debt portion (20%) for the year, that’s $4,032. Not too shabby!

2. Add on a Sub-Share Savings Account

We refer to our basic savings accounts as Share Savings accounts, but we offer secondary separate savings accounts called Sub-Share Savings. Many of our members use these to save for big purchases like Christmas gifts, vacations, home emergencies, and more.

Why open a separate savings account? Well, you have more than one financial goal, right? It’s best to align your accounts with targeted savings goals, i.e., if you’re planning a big Christmas gift list for next year, give Christmas shopping its own account. You’ll be able to track your progress on the way to being Santa entirely separate from your main savings account. Best yet, when you have multiple accounts, it’s less likely you’ll dip into your main or emergency accounts to make big purchases.

Check out our current sub-share savings rates now and see what one of our members recommends for holiday budget planning.

3. Lower Your Car Payment – and Other Vehicle-Related Expenses

For those with a car payment, it’s one more chunk out of your monthly stash. But, did you know it’s relatively fast and easy to refinance your auto loan? If you have a decent credit score and a history of six to 12 months of on-time payments, you can get started now. Smart sources suggest you could save $1,000 or more over the life of your loan, while quick calculations with online tools suggest you could save $300 or more per month!

Apart from refinancing your auto loan, there are lots of car-related savings ideas to list. Here’s a few to try out ASAP:

- Clean up your driving record: Get a copy of your driving record from the DMV and see if there’s anything you can pay off. A clean record, when submitted to your insurance company, frequently results in a lower insurance rate.

- Increase your insurance deductible: NerdWallet’s research found that increasing a deductible from $500 to $1,000 saved an average of $200 annually.

- Buy used: Cars drop in value the minute you drive off the lot, and new rides will also depreciate by twenty to thirty percent in the first year alone. Buy used and avoid this loss.

- Look for high resale values: When you buy cars that hold value better than others, you’ll get back more of your original investment.

4. Open a term share certificate

Want your money to go a little further while avoiding big risks? You might be happy with a certificate. A term share certificate is a certificate of deposit in which you invest funds for a specific period in exchange for dividends and a higher interest rate than an ordinary savings account. The longer your term, the more you’ll make in dividends and interest, helping you save and earn more. With a term share certificate, you’ll get bigger perks without the risks associated with the stock market and other, scarier ventures.

Check out our current rates for certificates here.

5. Start Investing

Ready to push the cash-envelope and save, plus extra perks? In addition to the Term Share Certificates mentioned above, our members have access to many kinds of investments:

| WHAT | WHY |

| Money Market Account | Earn higher interest rates and access your funds whenever, with up to six transactions per month. |

| Roth IRA | Get taxed at the time of your deposit, rather than when you withdraw the funds later. |

| IRA Certificates | Earn a higher, fixed dividend rate for a certain period on funds in your retirement savings. |

| Self-Employed Pension Plan (SEP) | Make contributions to your IRA, or if you’re a small business owner, make contributions to your eligible employees’ IRA accounts. |

| Education Savings Account (ESA) | Save money with an IRA-style interest rate to help your kids with their future educational expenses. |

Let’s Save You More $$$ in 2019

Whether your savings goals are for right now, geared to the future, or have your sights set on both the short- and long-term, our Member Advisors can help you create the right mix of savings options.

Stop in and see us at one of our convenient locations in Kaukauna, Little Chute, Grand Chute, Wrightstown, and De Pere, or learn more about our savings and investment options right here on the web.

Want more? Try out our simple savings calculator and get the latest financial tips on our blog.