Comparing College Costs for Students from Northeast Wisconsin

January 22, 2019

If thinking about the cost of college and how you’ll pay for it feels daunting … maybe it should.

The price of a four-year college education has increased significantly both in Wisconsin and around the country. Average tuition at state schools in Wisconsin was less than $2,000 in 1997, but has more than tripled to nearly $6,500 in 20 years. That’s before you factor in textbooks and room and board.

Meantime, staggering student debt in the U.S., which has surpassed $1.5 trillion is being called a crisis as student loans have surpassed total credit card debt by more than $600 billion. The average borrower has more than $37,000 in student loans upon graduation, which means college grads are paying lenders hundreds of dollars, month after month, for as long as 20 to 30 years.

While those numbers are overwhelming, most people believe that a good education is priceless, and it should serve as a springboard to a successful life and career.

Whether you’re a student in Northeast Wisconsin looking to attend college, or a parent/guardian trying to help a loved one come up with a viable financial plan, you’ll need to ask important questions and make major decisions about the future.

Here are some insights to help you come to the right conclusions …

The Cost of College in Wisconsin: Should You Stay or Go?

Part of the college experience is getting away from home, living on your own, and experiencing new people and places while gaining independence. There are, however, plenty of good reasons to stay in Wisconsin for college, and the impact on your budget is one of them.

If you compare average college costs of all 50 states, Wisconsin falls near the middle of the pack. It’s considered the 38th most affordable state to attend college. But, the real advantage surrounds students who are Wisconsin residents and receive in-state tuition rates.

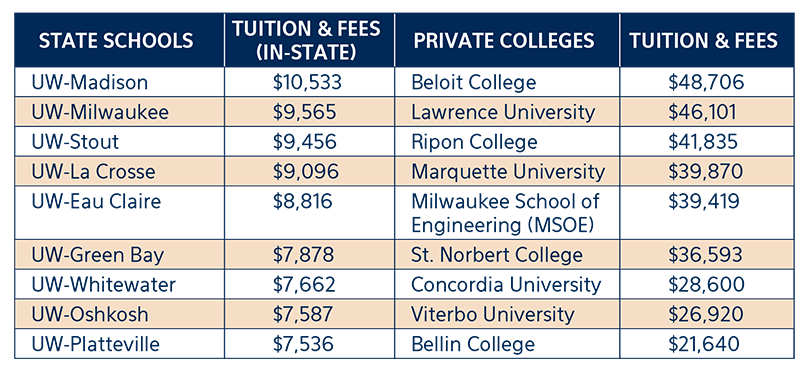

According to the annual College Board survey, the national average for tuition and fees in 2018 was $9,970 for in-state residents attending public schools. In Wisconsin, the average for in-state tuition and fees is $6,152. That’s compared to nearly $11,000 for non-Wisconsin resident students.

Outside the University of Wisconsin System, there are also respected private colleges, to which students may wish to apply. The College Board reports the average cost of a private university in Wisconsin was around $25,000 in 2018.

Of course, averages can be deceiving. The cost of attending college will depend greatly on the school to which a student is accepted. Here’s a cost comparison of some of the more popular college choices in Wisconsin, according to data from CollegeTuitionCompare.com, where you can search for information on other schools.

The Cost of Attending a Four-Year College in the Midwest

If getting out of the state is a priority, there are opportunities for more affordable post-secondary educational experiences at colleges within the Midwest.

You’ve likely heard of the tuition reciprocity agreement between Wisconsin and Minnesota. The arrangement allows Wisconsin students to attend Minnesota public colleges at in-state tuition rates. You must apply to receive tuition reciprocity, and it is not available for private colleges in Minnesota.

Beyond that agreement, Wisconsin college students can also take advantage of the Midwest Student Exchange Program (MSEP). Under this program, more than 100 colleges and universities provide students in participating states with reduced out-of-state tuition.

MSEP includes select colleges in these states:

- Illinois

- Indiana

- Kansas

- Michigan

- Minnesota

- Missouri

- Nebraska

- North Dakota

- Ohio

MSEP says these schools will charge Wisconsin students no more than 150 percent of the tuition rate that in-state residents pay. So the most it would cost is 50 percent more than the in-state rate, which could be significant once you take into account the fact that non-Wisconsin residents might pay nearly twice as much at state schools. Participating private institutions in the MSEP also offer a 10% reduction on tuition.

Savings from the program vary, but participating students could save as much as $5,000 a year. You’ll need to apply for the program can contact a high school guidance counselor or coordinating MSEP state offices for more information.

The Cost of College Outside the Midwest

Whether it’s the desire to move to a warmer climate, live in a certain city, or go to a specific school, some students may want to attend college even further from their home state of Wisconsin. That’s where the cost of college could start getting a bit pricier.

Part of this is because there are more prestigious and expensive universities in regions such as the East Coast where many Ivy League schools are located. But, there are many other states where the typical out-of-state tuition and fees are quite high in comparison to college costs in Wisconsin.

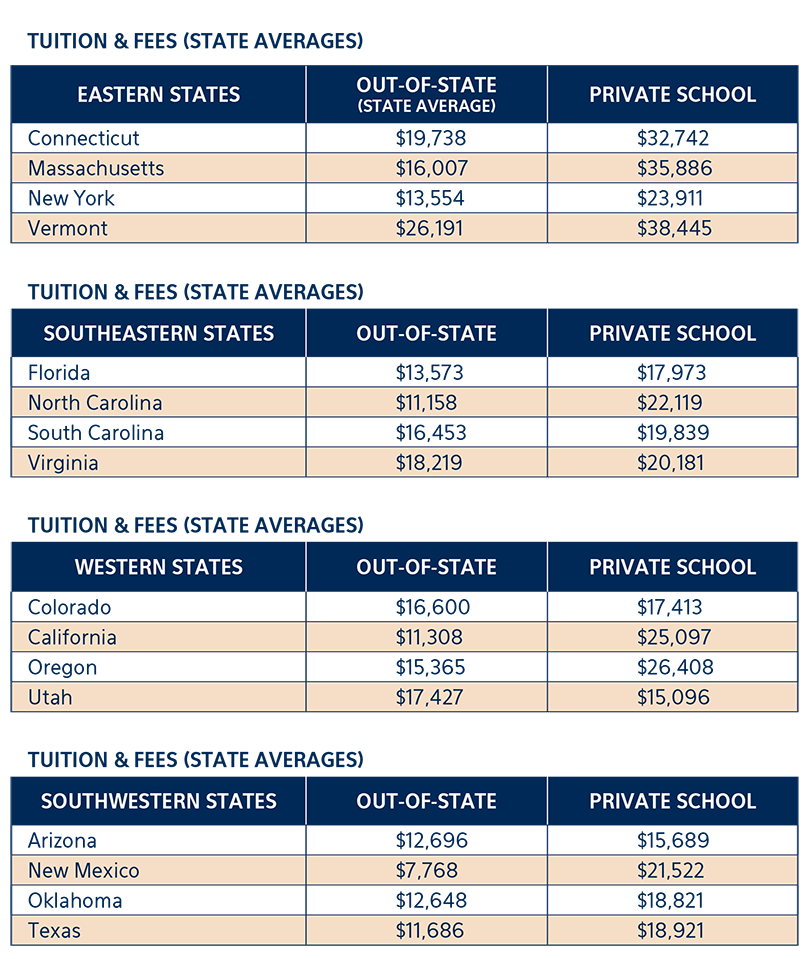

The graphic below displays the average costs of several states outside of the Midwest, according to CollegeTuitionCompare.com. As you’ll see, averages differ greatly, even within the same region.

Benefits of Choosing a Two-Year College in Wisconsin

Because of the rising cost of a college education, and changes employment opportunities, more young people are acquiring two-year degrees at community colleges and technical schools.

While acceptance to many four-year colleges may depend on your grades in high school, that’s less important at two-year schools, which usually only require a high school diploma or GED.

Local technical schools and community colleges provide unique advantages beyond a more affordable price. They tend to have smaller class sizes, which means students have more direct communication with instructors. Attendees can focus on specific trades and marketable job skills. And, it’s often easier to find a job in the community after or even before graduation because the schools have direct connections with local employers.

Many of the fastest-growing jobs in Wisconsin don’t require a four-year degree, and attending a two-year college may be the ideal path to a successful career. According to the Job Center of Wisconsin, “hot jobs” in the state with salaries above the state median include:

- Truck drivers

- Maintenance and repair workers

- Accountants and auditors

- Carpenters

- Welders

- Construction laborers and supervisors

- Nurses

- Dental assistants

- Plumbers

- Information technology jobs (IT)

- Industrial mechanics

You can find programs for these career paths at local technical colleges in the Fox Valley/Northeast Wisconsin.

Other Wisconsin students may plan to attend a four-year college later, however, they choose to take some of the more basic college courses and prerequisites at two-year schools first. This helps reduce the cost and gives students time to think about which major they’d like to pursue.

Changing majors could mean spending extra time in college, which may add to student loan debt. Students can pick and choose courses they’d like to take at two-year colleges, letting them gauge their interest in different pursuits without committing to a specific degree.

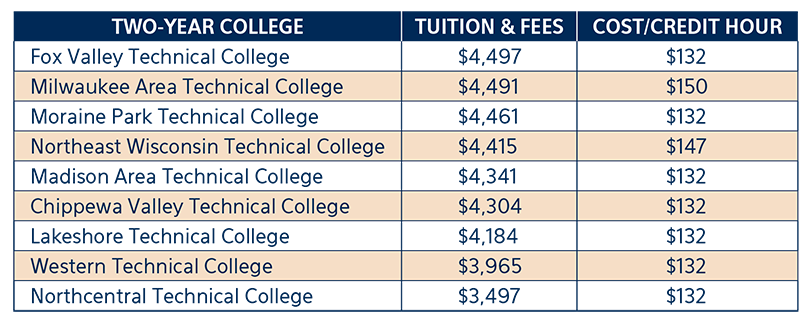

Take a look at how tuition costs differ in the graphic below. It also includes the approximate cost per credit hour. There are several respected two-year schools in the Green Bay/Fox Cities area and around the state.

Financial Assistance for College-Bound Students in Wisconsin

Many families in Northeast Wisconsin will seek some sort of financial assistance to help pay for college. You should see if you qualify for federal aid by filling out a FAFSA form. The website Taming the High Cost of College also provides a breakdown of what you can expect to pay at UW schools and private colleges based on your household income.

If attending UW-Madison is your plan, a program called Bucky’s Tuition Promise was introduced in 2018, which could provide free tuition for students from families with household incomes under $56,000 a year.

Applying for scholarships is yet another way to help pay for college. We’ve written about local scholarships for Northeast Wisconsin students here on our blog. There are many options, including some that are exclusively for students in the Fox Cities.

Apply for the John Aman Memorial Scholarship

Unison Credit Union is proud to provide our very own scholarship to college-bound students in our area. Each year, the John Aman Memorial Scholarship awards $2,000 to several students who are actively involved in their communities and have plans to make a positive difference. The scholarship honors the memory of our credit union’s first president, a man who believed in volunteerism and putting others first.

That philosophy continues at Unison Credit Union today. We are dedicated to empowering people in the communities we serve, no matter what stage of life they may be going through.

We have student loan solutions backed by Salie Mae®, and our U Choose loans can help families cover major college-related expenses beyond tuition and room and board. Students attending college in our area can also start their financial futures at a reliable credit union instead of a big bank by opening their own personal checking accounts and savings accounts.

After graduation, Unison Credit Union and our helpful Member Advisors are here to help guide you on big financial decisions, from buying a home to consolidating student loans. Stop in at one of our six conveniently located branches soon to learn more.