Empowerment Series: How Smart Savings Practices Helped a Young Fox Valley Family Plan for the Future

March 29, 2019

Moms, dads, and step-parents, you’ve taught your kids so much already. Whether it’s how to ride their first bike, tackle playground conflict head-on, or treat Grandma to a home cooked breakfast, each of the lessons you’ve taught your kids will help them meet their future as prepared young adults.

But, have you taught them any financial lessons?

Recently, a Fox Valley couple stopped in to find a way to teach their kids how to save. By showing their kids how to save now, these parents are ensuring that their kids will be set to manage money in the future—and that they’ll have a nice little nest egg from which to draw once they finish high school.

Want to teach your kids how to save, too? Read on and we’ll show you how a Unison Member Advisor used smart savings strategies to help this young family get a jumpstart on saving for the future, learn big financial lessons, and meet their personal goals in the present.

Three Kids + Two Parents = Big Savings Goals

Ryan Rothe, Unison Credit Union Member Advisor

Our Fox Valley family is comprised of five people—three kids (8, 6, and 3 years old) and two young parents. Mom and Dad came in to see Ryan Rothe, a Member Advisor at our Kaukauna South branch, to learn how they could start putting away money each month for their kids.

After talking about what they wanted to accomplish, Ryan helped Mom and Dad set up three savings accounts into which a portion of their paychecks would be deposited every month.

The goal for Mom and Dad was to have an account for each child to use once the kids turned 18, perhaps for college costs or a vehicle. Ryan came to the rescue—he was able to set up an easy-to-manage savings plan to guarantee a bright financial future for each child. Ryan also showed Mom and Dad how to change auto-deposit settings via our handy online account management program, saving these busy parents precious time.

But, what would those accounts look like when each kiddo turned 18?

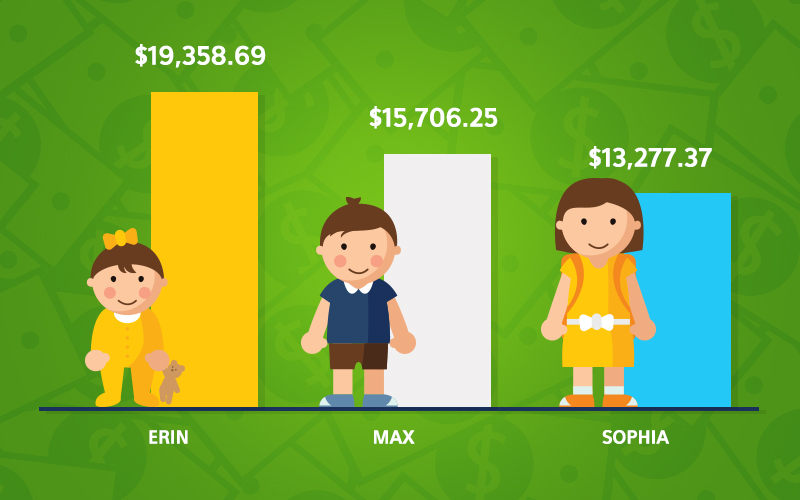

Let’s say that Mom and Dad put $50 in for each child per paycheck, and that they get paid twice per month. We’ll name the kids to help illustrate a point.

Here’s how much each kid would have socked away—with interest*—by the time they turned 18. These figures were calculated assuming Mom and Dad started with $5, were able to put away the same amount each month, and that APY and dividends each year were 0.10%, respectively.

*Interest compounded monthly.

By putting away $50 each paycheck per child, Mom and Dad will be able to set each of their kids up for a bright financial future. Even Sophia will be able to buy a solid used car with her nest egg. These nest eggs could be even bigger if Erin, Max, and Sophia are able to save money themselves. Birthday money, excess allowance, and money from babysitting, shoveling, or lawn mowing would just grow each kiddo’s balance over time!

Wondering how much you might be able to save? Try out our Simple Savings calculator.

Curious to know how much a used car costs right now? Check out our blog post that reviews popular, safe, and stylish used cars and what they’re listed for now.

Saving for Mom and Dad

When our Member Advisor was figuring out a savings plan for the kids, he learned that Mom and Dad were planning their 10th wedding anniversary. (Congrats, guys!) Their dream anniversary trip included warm weather and a sandy beach, so Ryan took action to help them get there.

Mom and Dad now have a sub-share account under their main savings account titled “Anniversary” with auto-deposit set up. Ryan made sure enough would be deposited each month to reach their goal. Now, all they have to do is use the account when they’re ready and book their travel plans. It’s a solution that makes saving simple.

Want to take a warm-weather trip to escape winter in Wisconsin? See where Wisco snowbirds are flying off to.

Talking to Your Kids About Money

If you find the idea of talking to your children about money uncomfortable, you’re not alone. 69% of parents feel some reluctance when it comes to talking to their kids about money, and only 23% of kids say they talk with their parents about money on a regular basis.

Luckily, experts like Dave Ramsey have tips for broaching the money subject with your little ones.

Tips for Talking to Kids About Money

- Start slow. It’s pretty simple. When your kids start asking questions about money, answer them. They don’t need a “five-hour lecture” right off the bat, as Dave Ramsey says.

- Be honest. If there are parts of your financial past or present that you’re not proud of, tell your kids about them. They’ll respect your openness and learn valuable lessons from your missteps.

- Talk values, not figures. Kids don’t need to know the nitty-gritty of your bank statements. Talk to them in big-picture values like “debt” and “savings.”

- Set family goals. Including your kids in family budget discussions will help them learn how to set goals and reach them—and that meeting goals means sacrificing other things in your budget. Of course, you’ll need to enforce the point that Mom and Dad are in charge.

- Learn about money together. Look, most adults don’t know everything about their finances. When you hit a topic you don’t understand, you’ll find that figuring it out enough to explain it to your child will turn you into an expert on that topic.

Get more tips from Dave Ramsey here.

Make Financial Goals and Reach Them with Unison

Our Fox Valley Mom and Dad have been Unison members for just a short period of time, but they’ve already figured out their savings strategy with a Member Advisor at their side. The next step? They’ve been working with Ryan to get their car and mortgage loans moved over. As Ryan says, “this was just another way that we are able to help members become financially stable by taking a bit of time to listen to what they want.”

Would you like to meet your financial goals with a dedicated financial expert along for the journey? Our Member Advisors are well-versed in all things moola and would love to sit down with you to figure out what you want and how to get there. Stop by one of our convenient local branches in Kaukauna (North or South), Wrightstown, De Pere, Little Chute, or Grand Chute, or get in touch with us online today. We can’t wait to hear from you!

Looking for more savings options? Check out our timely tips for saving more money in 2019.