Protect Yourself from Debit Card Fraud

January 19, 2023

How it happens and how to protect yourself!

Fraud continues to be a prevalent issue worldwide. Fraudsters have stolen data from millions of debit card holders through merchants big and small. Debit cards are among the most popular payment methods for both physical and digital transactions. Furthermore, as the Covid-19 pandemic has led to a digital transformation, contactless methods like debit and credit cards, as well as e-wallets have gained further traction since 2020. From large venues and stadiums to mom-and-pop shops, we continue to see a large trend in cashless payment options forcing consumers to use their debit and credit cards.

How it Happens

- Hacking. When you bank or shop online using public Wi-Fi networks, hackers can use software to capture everything you type, including your name, debit card number, and security code.

- Phishing. Be wary of messages soliciting your account information. Emails can look like they are from legitimate sources but are from scammers.

- Skimming. Identity thieves can retrieve account data from your card’s magnetic strip using a device called a skimmer. A skimmer can be attached to ATMs and store card readers. The data obtained is then used to produce counterfeit cards.

- Vishing. Fraudsters call a victim stating they are an employee from their bank or credit union and inform the victim that there is a problem with their account or debit card. A false alert may also arrive by text or email initially, asking the victim to call a number to resolve an issue.

- Spying. Criminals can place cameras near ATMs or simply look over your shoulder as you take out your card and enter your PIN.

- Unison Credit Union will never call you and ask for your account number, social security number, or your credit card or debit card number, BUT…if you are a victim of fraud, you will receive a call from our credit and/or debit card provider that will alert you that your card has been compromised.

- This call will likely come from Omaha, Nebraska, show up as a 402-area code or say FISRV on your caller ID.

- The caller will tell you that they are calling from Unison Credit Union, but they might sound like they are not from the area. This may have you thinking that this is a fraudulent call, but in fact, they are calling on behalf of Unison.

- If you have received a call and you are concerned about its validity – hang up and call us at 920-766-6000 to speak with a Member Advisor during regular business hours.

- Monitor your accounts for unauthorized charges or debits. Report any problems or concerns right away. As a consumer, it is important to set up alerts to help monitor your transactions.

Do you have our mobile app?

If so, you can activate alerts and lock your card from anywhere at any time! Here are some easy step-by-step directions to help manage your card controls.

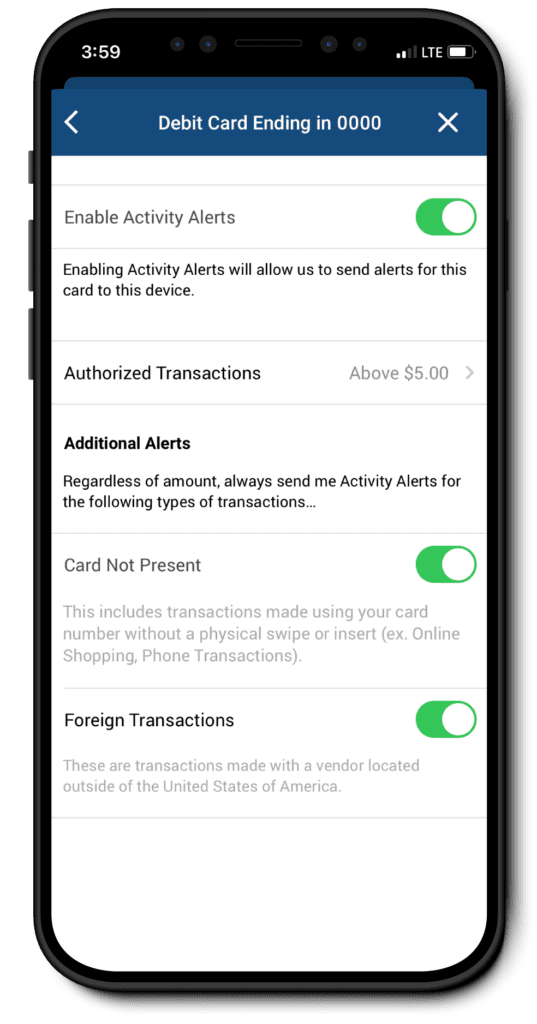

Enable Debit Card Alerts

- Log in to the UnisonCU mobile app.

- Under the Home tab, select Manage Debit/Credit Card OR select the Manage My Cards icon under the More tab.

Select the credit or debit card you would like to activate alerts on.

Note: You may need to enable push notifications. - Select the Edit Activity Alert Settings

- Turn on the Enable Activity Alerts toggle.

Note: The Card Not Present and Foreign Transactions toggles should automatically be turned on. If not, switch them on. - To set notifications for a transaction threshold, select the Authorized Transactions and enter a dollar value.

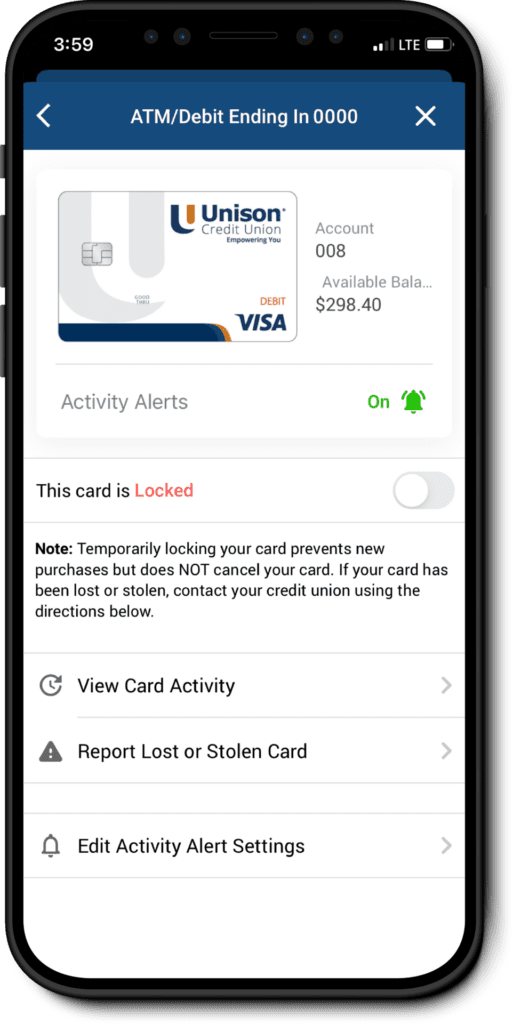

Temporarily Lock a Debit Card

- Log in to the UnisonCU mobile app.

- Under the Home tab, select Manage Debit/Credit Card OR select the Manage My Cards icon under the More tab.

Note: You may need to enable push notifications. - Select the credit or debit card you would like to activate alerts on.

- Switch the toggle on the This card is Active

- Confirm to Lock the card.

Note: To Unlock switch back the toggle.

We are here for YOU! If you feel like your card has been compromised, or you think you might be a victim of fraud- please reach out by email at memberservice@unisoncu.org or call us at 920-766-6000 during regular business hours to speak with a member of our team today.